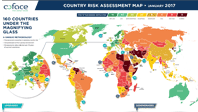

Coface Country Risk Outlook 2017

- Ratings Upgrades for 11 Countries, Including Spain and Argentina

- Mexico and South Africa Among the Four Downgrades

- Political Risk Levels Remain High

Global trade credit insurer Coface today released its 2017 forecast for the global economy and the quarterly update to its assessments for 160 countries.

World trade under the threat fROM protectionism

Following two years of slower world growth, the outlook should improve slightly in 2017, up from 2.5% to 2.7%. This outcome will be driven by a rebound in emerging countries, with expected 4.1% growth due to recoveries in Brazil and Russia that will offset the slowdown in China. Advanced countries will see stable growth of 1.6%.

The lackluster outlook for world trade, forecast at 2.4% growth for 2017 – compared to an average of 2.2% between 2008 and 2015 and to an average of 7.0% between 2002 and 2007 – could be further compounded by the resurgence of protectionist measures following the election of Donald Trump. In the short term, these measures will have a lesser effect on America’s economy at the end of the cycle (+1.8%) than they will have on other countries that export heavily to the USA, including Mexico, Ecuador, Honduras, and El Salvador in the Americas, and Thailand and Vietnam in Asia.

Given Mexico's strong reliance on exports to the USA, which represent 7% of GDP, and a situation of higher inflation and falling investments, Coface is downgrading Mexico’s country risk assessment to B. Argentina, however, will be relatively immune to the "Trump effect” and, after a difficult year, should start to reap the benefits of its reforms. Coface is upgrading the country risk assessment for Argentina to B.

Global political risks at a record high in 2017

Political risks will continue to be a major concern in 2017.

Among the advanced economies, Europe is facing the greatest political uncertainty as it awaits the outcome of a number of decisive electoral battles, as well as the exact terms of Brexit. Over the last year, Coface's European political risk indicator has increased by an average of 13 points for Germany, France, Italy, Spain, and the United Kingdom. Another major political upset on the scale of Brexit could slow European growth by an average of 0.5 points.

Political risks in emerging countries are higher than ever, driven by social discontent and heightened security risks. The CIS and North Africa/Middle east regions show the greatest risks among the major emerging economies. The rise of political risks, social frustrations and poor growth are to blame for the downgrade of South Africa to C.

high levels of company debt are a threat to the banking sector in emerging countries

Company insolvency rates should continue to fall in advanced economies. However, the number of new companies being created is often lower than pre–crisis levels. For example, the number of new business establishments between 2015 and pre-crisis peak levels was -19.8% in Germany,

-5.1% in the United States, and -4.1% in Italy. Bank loans granted to highly-indebted companies are straining the resources available for younger, fast-growing companies.

Excessive company indebtedness is also a problem for emerging countries. Companies in China have the highest levels of debt, at more than 160% of GDP, a level that rose by 12 GDP points between the second quarter of 2015 and the second quarter of 2016. The rate of bad debt in the banking sector is rising sharply in Russia, India, Brazil, and China, while credit conditions are becoming stricter.

Upgrades in Europe and sub-Saharan Africa

For first time since mid-2015, Coface has made more upgrades than downgrades in its country risk assessments.

Spain has been upgraded to A3, while Iceland and Cyprus, where risks related to capital controls are decreasing, are now assessed A2 and B, respectively. In Central Europe, Estonia (A2),Serbia (B) and Bosnia-Herzegovina (C) have all seen improvements in their business environments and growth in these countries is reaching comfortable levels. The recovery in Bulgaria (A4) is confirmed thanks to moderate growth and the continued consolidation of the banking sector there.

In sub-Saharan Africa, smaller countries are faring better than the larger economies. Two of the best performers in the region are Ghana (B), which passed its democratic maturity test in December, and now has a good level of public finance management, and Kenya (A4), which has seen a boost in tourism and increased public investments.

DOWNLOAD THE PUBLICATION "An economic upturn in the face of uncertainty"

-

World Economy: after a tumultuous 2016, a slight improvement in 2017

- Persistent clouds on the horizon for 2017: details of Brexit and US policies

- Political risk in 2017: possibility of storms

- Emerging countries: duos to monitor

DOWNLOAD THE last country risk map - January 2017

DOWNLOAD THE infograPHICS : An economic upturn in the face of political risk

Contact

Annie Lorenzana

COMMUNICATIONS MANAGER

North America

MOB: +1 (407) 221-3496

Annie.Lorenzana@coface.com