Country Risk Barometer Q2 2016 - China And The United States, Two Giants With Feet Of Clay

THE GLOBAL ECONOMY REMAINS STUCK IN A "JAPANESE-STYLE" TRAP OF SLUGGISH GROWTH, DESPITE EVER MORE EXPANSIONARY MONETARY POLICIES

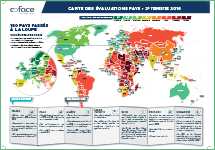

The spring started with positive indicators - good growth figures in Europe, a rebound in many emerging currencies and rising oil prices. But this is a calm in appearance only, as many "micro" risks appear as soon as we scratch the "macro" surface. In the two largest economies in the world, the United States and China, whose country ratings have been downgraded to A2 and B, respectively, perfectly illustrate the situation.

In China, the most widely followed economic indicators, such as GDP growth, retail sales and industrial production, show that growth is stabilizing. But company insolvencies are growing sharply. In the United States, hidden behind the continuous fall in the unemployment rate, there are companies with eroding profitability that are investing less. But the parallels between China and the United States stop there, as these "micro" vulnerabilities are different on the two sides of the Pacific. In China, companies are suffering from overcapacity and excessive debt, which will take time to reduce, while in the United States, company problems are more cyclical than structural. Six years after the beginning of the recovery, the turnaround point has been reached and we saw in a rise in insolvencies in early 2016, for the first time since 2010. If we add Japan (downgraded to A2 in March), the world’s three largest economies are seeing company credit risk increase in this first half of the year.

Unsurprisingly, Asian countries are negatively affected by the Chinese slowdown, and Coface has downgraded South Korea, Hong Kong, Singapore and Taiwan. Before the British referendum, Europe was - for a change - the herald of good news -- the country assessments of France and Italy have actually been revised upwards (to A2 and A3, respectively), under the effect of falling insolvencies, earnings that have stopped declining and ever more favorable lending conditions. Central and Eastern Europe is benefiting from the eurozone recovery. Romania, Slovenia, Lithuania and Latvia have been reclassified. In Europe, companies are expected to keep their positive growth momentum over the next few months, unless the consequences of the British referendum and other numerous political uncertainties spoil the party.

Download the publication: Country Risk Barometer Q2 2016

- China and the United States, two giants with feet of clay

- Country risk assessment changes

- Country reports for 10 countries

Download the infographics

Contact

Annie Lorenzana

COMMUNICATIONS MANAGER

North America

MOB: +1 (407) 221-3496

Annie.Lorenzana@coface.com