Information about business partners

Assess current or potential business partners through Coface Business Information

Make smarter credit and risk decisions with Coface Business Information

For more than 75 years, Coface has been a global leader in the credit risk industry. Leveraging our premium data, sector and country expertise, our Business Information solutions provide the tools and insights needed to make well-informed business decisions. Coface Business Information solutions help companies monitor risk with dynamic data and forward-looking insights.

Assess current or potential business partners through Coface Business Information

Rel8ed provides advanced, innovative data solutions to enhance compliance and prospecting

A global leader in trade credit insurance, Coface Business Information solutions are backed by a worldwide information network, advanced risk analytics, and best-in-class expertise. Our solutions leverage premium data from a powerful global network spanning 200 countries worldwide. We provide advanced insights created by our team of underwriting and financial experts that are layered with micro- and macro-economic research from our in-house Economics team.

Our Business Information solutions were built to make your life easier. From Business Reports to Scores, our solutions help you quickly and confidently assess risk and make smarter business decisions.

What could your business do with premium data and advanced insights? As it turns out, quite a lot. From identifying and on-boarding new commercial partners to checking the financial health and payment histories of customers, Coface Business Information solutions help you gain a clear understanding of companies' creditworthiness. Our solutions can also provide continuous monitoring to alert you of changes in financial state or other signs of risk.

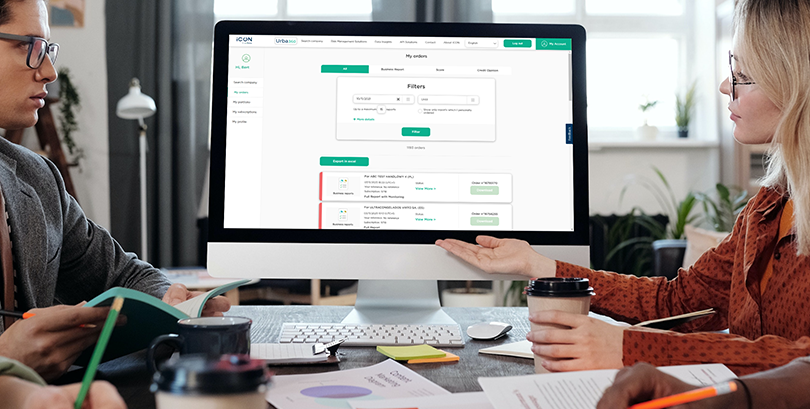

Coface Business Information offers customers access to premium data, advanced insights, and products to make smarter business decisions. Supported by our powerful intelligence platform, iCON by Coface, customers can expect easier access to real-time information, credit scores, economic analysis, and more.

Elevate your business strategy to proactively manage risk with Coface Business Information and iCON by Coface.

Coface Business Information is available through web data exchange solutions (API) tailored to your company’s needs. With Coface API, your business can easily access Coface credit insurance and risk information within your own business tools.

Whether you opt for a simple technical solution or all-inclusive integration, connection has never been easier. Explore Coface API catalogue for integrated solutions for trade credit insurance and Business Information.

Online services for customers and brokers

Business Information

Access the business insights you need to manage credit risks across your entire business-partner portfolio and make strategic decisions with confidence.

Broker Portal

Platform dedicated to brokers for monitoring your business and managing your customer portfolio (in all countries where legally available).

Customer Portal - CofaNet

Coface online platform for managing your trade receivables. Full monitoring of your risks. Direct access to all tools according to your contracts.

Innovative and digital solutions

API Portal

Stop juggling between software applications. Explore Coface API Catalogue and Integrated Solutions for Icon by Coface and trade credit insurance.